19 million Brits are “financially precariat”, data reveals

The poorest 30% of the UK population as a whole spend more than they earn, new analysis reveals.

By Helen Breese | Published on 3 September 2018

Categories: Press office; Nottingham Civic Exchange; Research; Nottingham Business School;

A new tool available here developed by Nottingham Trent University and the RSA, aimed at economic policymakers and based on official ONS figures, indicates dependency on overdrafts and payday loans is likely widespread among this group.

The RSA and Nottingham Trent call on the government to make a renewed focus on economic insecurity and understanding the precarious finances of those “just about managing” and those not managing to get by.

This finding mirrors separate research from the RSA and Nottingham Trent University in February, which similarly found that around 30% of respondents to an RSA/Populus survey said they were not able to get by. Another 30% said they were only “just about managing”.

Tom Harrison, researcher at the RSA, said: “Debt is often thought of as a problem only for the very poorest or those who lack the supposed moral character to avoid tempting purchases.

“But our data reveals that around the bottom 30% of earners spend more than they make – indicating financial precariousness is much more widespread than many feared.

“Our research also shows that this group are spending more on essentials than luxuries, indicating debt is likely being used to buy food and pay rent, rather than TVs or smartphones.

“With a decade of disruption looming from the challenges and opportunities of automation, as well as Brexit uncertainty, we urgently need a new focus on economic insecurity from policy-makers to support households – 40% of which have less than £1,000 in savings.”

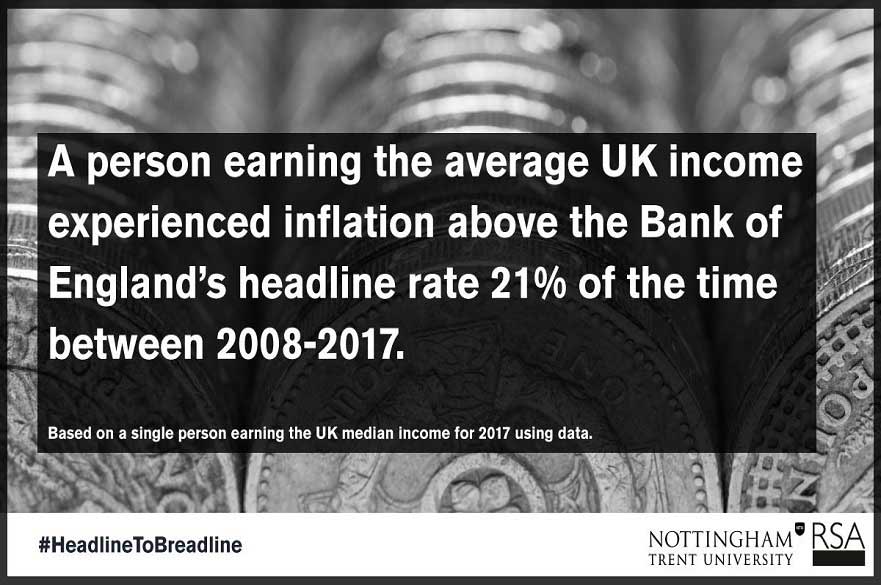

The tool also shows that inflation is not experienced as a single national figure but that rising living costs vary depending on what households purchase, with housing costs in particular varying hugely by age and region. For instance:

- A stereotypical “Just About Managing” couple, courted by both major parties, aged 35 on an income of £35,000 and living in the East Midlands with two children, have a higher than headline rate of inflation for 51% of the time; higher than average for 60% of the time. The statistics suggest such a couple would spend 102% of their income, indicating a problem with debt for such “Just About Managing” couples.

- A 65-year old couple in Scotland on an income of £50,000 would have only experienced inflation rate above headline rate for 21% of the year and higher than rate average for 31% of the year.

- An 80 year old in the North East on £12,000 a year, in the bottom decline of household income, inflation would be higher than the headline rate for 64% of the time and higher than the average rate of inflation for 72% of the time, showing pension poverty remains a problem for many left-behind groups.

- Meanwhile in London, a 28-year old single adult with a dependent child, on an income of £22,000 pays proportionately more than 93% of the population on housing and fuel costs.

- Even a relatively affluent couple of 28-year olds in London on £65,000 – in the top 20% of earners – pay proportionately more than 79% on housing, showing house price inflation extends well into household finances, even though this is not officially reflected in the ONS figures.

Previous RSA research on tackling economic insecurity found 80% of UK workers worry inflation will outstrip their pay. Meanwhile 40% have less than £1,000 in savings, and 30% of households say they are not currently managing to get-by.

Providing a tool that highlights how inflation and household spend differs across society is an important way to help people understand how the economy affects them and how they can engage with it. We hope our data tool can support people to become more informed of their position and raise the awareness of economic insecurity across the UK.

Rich Pickford, Knowledge Exchange and Impact Officer at the Nottingham Civic Exchange

Nottingham Business School second year students, Harry Cooke and Katie Biggerstaff, worked with NTU staff and the RSA on Headline to Breadline.

Nottingham Civic Exchange

Nottingham Civic Exchange has been established by Nottingham Trent University to maximise research, policy and practical impact by bringing together university expertise with partners seeking to address the needs of communities. Nottingham Civic Exchange acts as a resource to look at social and economic issues in new ways. This means facilitating debate, acting as a bridge between research and policy debates, and developing practical projects at a local, city and regional level.

Visit our website - www.ntu.ac.uk/nce Contact us - notts.civicex@ntu.ac.uk Follow us - @NottsCivicEx

Notes for Editors

Press enquiries please contact Helen Breese, Public Relations Manager, on telephone +44 (0)115 848 8751, or via email.

Nottingham Trent University (NTU) was named University of the Year 2017 at the Times Higher Education Awards, and Modern University of the Year in the Times and Sunday Times Good University Guide 2018. These awards recognise NTU for its high levels of student satisfaction, its quality of teaching, its engagement with employers, and its overall student experience.

NTU has been rated Gold in the Government’s Teaching Excellence Framework – the highest ranking available.

NTU is one of the largest UK universities. With 30,000 students and more than 4,000 staff located across four campuses, the University contributes £900m to the UK economy every year. It is one of the UK’s most environmentally friendly universities, containing some of the sector’s most inspiring and efficient award-winning buildings. 96% of its graduates go on to employment or further education within six months of leaving.

Our student satisfaction is high: NTU achieved an 88% satisfaction score in the 2018 National Student Satisfaction Survey.

The University is passionate about creating opportunities and its extensive outreach programme is designed to enable Nottingham Trent to be a vehicle for social mobility. NTU is among the UK’s top five recruiters of students from disadvantaged backgrounds.

NTU is home to world-class research, and won The Queen’s Anniversary Prize in 2015 – the highest national honour for a UK university. It recognised the University’s pioneering projects to improve weapons and explosives detection in luggage; enable safer production of powdered infant formula; and combat food fraud.

With an international student population of over 3,000 from around 100 countries, the University prides itself on its global outlook.